This partnership focuses on streamlining financial processes using Stablecoins, enabling faster, cheaper cross-border transactions.

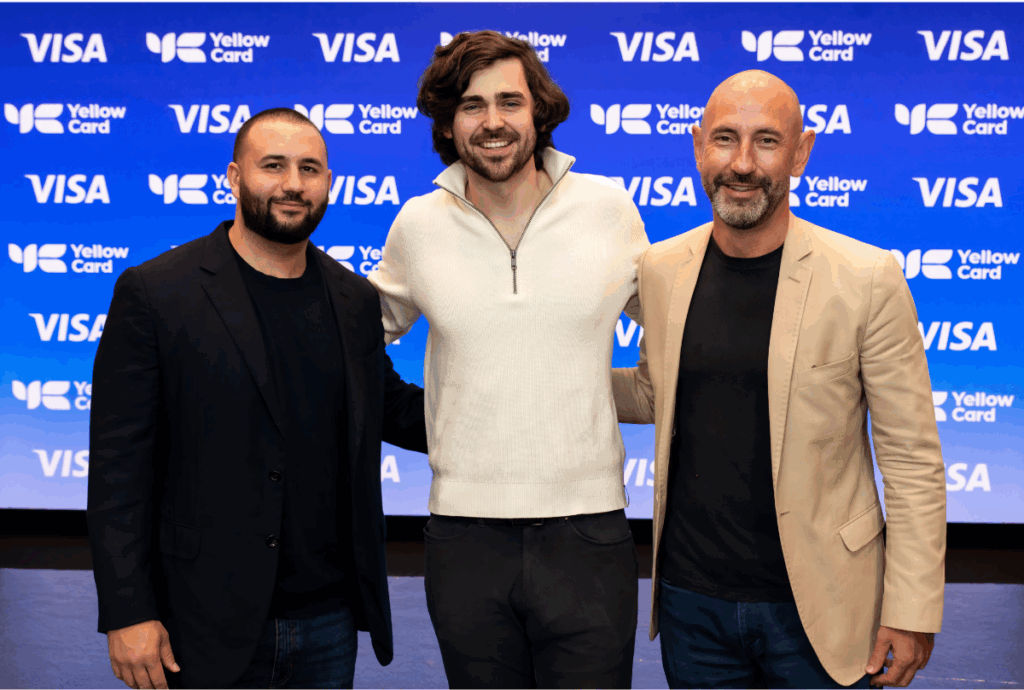

Yellow Card announced its partnership with Visa, the leading licensing stubcoin payment orchestrator in Africa and the emerging world and a global leader in digital payments, driving the next phase of innovation in cross-border payments and financial infrastructure in emerging markets where Yellow Card is charged for a license to operate.

Through this partnership, Visa and Yellow Card will work together to help streamline Stablecoin's use cases and financial operations, strengthen liquidity management, and explore opportunities to enable faster, more cost-effective money moves across borders.

“Traditional payment companies continue to question “If you want a Stablecoin strategy, then “” “”” and how quickly it can be deployed.” We are excited to partner with Visa to help realize the potential of Stablecoins technology in emerging economies. ”

– Chris Maurice, co-founder and CEO of Yellow Card.

“We are excited to work with Yellow Cards to enable faster, more accessible digital payments. We believe that every institution that moves money needs a stable strategy. As more players in the payment ecosystem explore this powerful new technology, Visa is ready to help partners navigate transformation, bring scale and build the next generation of global payments.”

-Godfrey Sullivan, Senior Vice President and Head of Products and Solutions at CEMEA, Visa

Operating in more than 20 African countries, Yellow Card provides access to secure, compliant and accessible Stablecoin products for consumers, businesses and developers. This partnership further strengthens the role of Yellowcard as a key financial gateway and infrastructure provider in emerging markets.