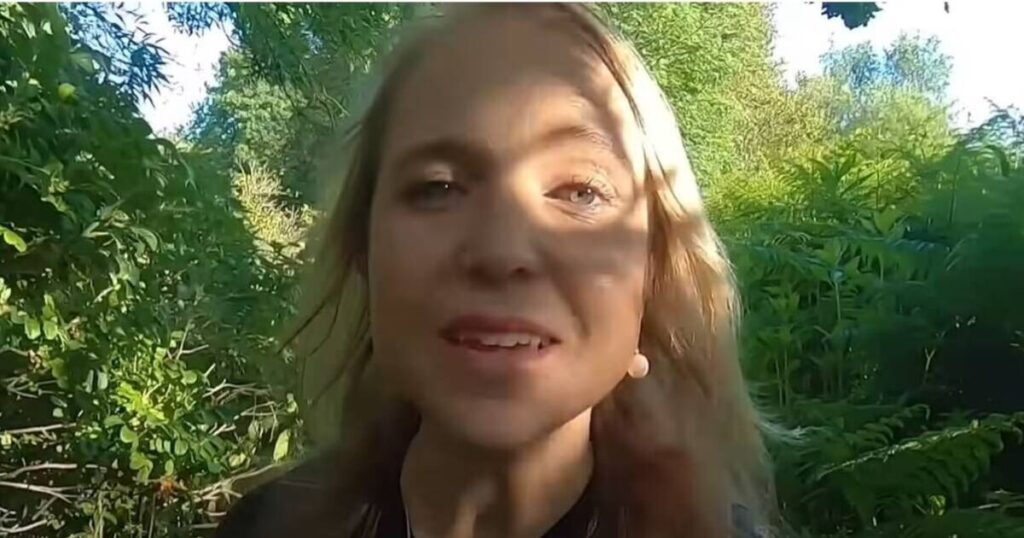

American foreigners who have experienced life on both sides of the pond spilled beans in Manchester's biggest culture shock. Her video, “Americans in the UK: 15 British Culture Shocks,” travelling with globetrotter Christine Wilson and Christine YouTube's fame, jumps into the surprises they encounter in the UK. Manchester, Christine's former stomped ground, proved to be eye-opening.

Amidst revelations about personal safety, food discoveries, couples' grocery shopping escape, stunning recycling efforts, and “common sense” signs, it was the price of bricks and mortar that really out-of-balance her. Christine had noticed the reputation of London's wallet drain, but the Mankunia housing market left her entanglement. Christine revealed her surprise, saying, “But perhaps the most shocking thing was the price of the home here. Now I know London is expensive, but I didn't think the market was that competitive in Manchester.”

She speculated about the cause. “I have heard that because a lot of people are moving from London to Manchester in search of cheaper housing.

Christine then elaborated on the fierce nature of home hunting in Manchester, and compared it to the fierce competition in New York or LA.

Christine expressed surprise at the UK real estate market conditions, noting that prices are “really high” and that competition is “very competitive.” It was reported last September that price disparities appear to be narrowing between the north and south.

An exclusive land registration analysis by men revealed that London's previous 12 months average real estate prices sold exceed £694,731 in five areas of Manchester.

These high value Manchester areas included Haleburn, Ashley, Bowdon, Dunham Massey and Hale. That said, in London, other properties, including detached houses, earned an average of £1,274,365.

As reported by GB News, UK property prices continue to rise, with an increase recorded in all regions. In the northeast, the most significant annual inflation rate rose from 9.1% to 6.9% in December, according to ONS figures.

However, when comparing average home prices in the UK, it rose 4.8% compared to the previous year, reaching the average price this January to £291,000.