When Visa invested in Nigeria's Fintech Mony Point earlier this year, it wasn't just a test of the newly-built unicorns – it took a bold new direction.

As part of that deal, Nigerian Fintech is best known for building one of Africa's largest business banking platforms, suggesting plans to integrate with Visa Direct.

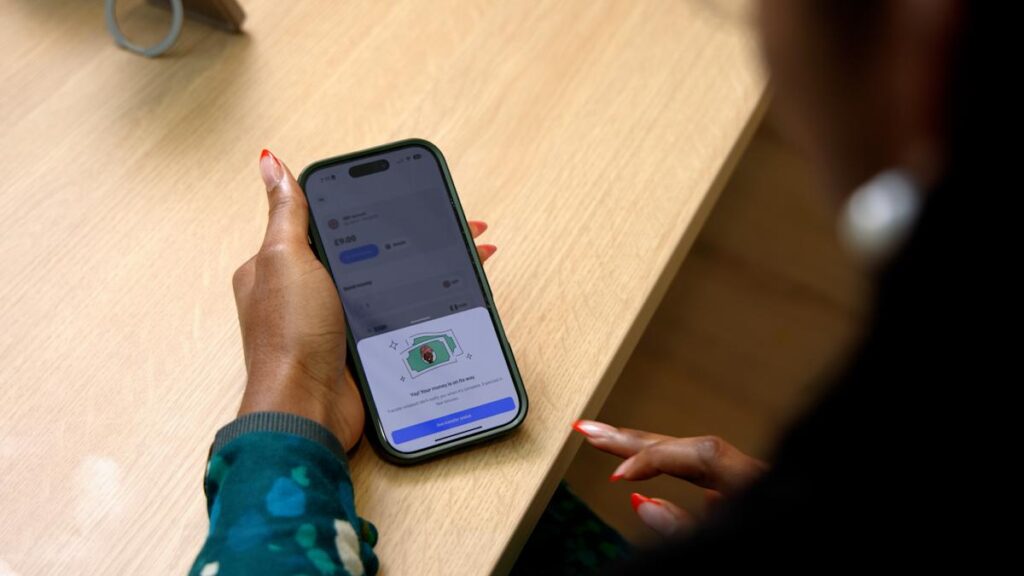

This strategy is now shaped by the launch of Monieworld, starting with the UK-Nigeria corridor, the first foray into financial services focused on Diaspora. However, this is not just another play on the amount of money transferred, claims founder and CEO Tosin Eniolunda. “We're not trying to become a money transfer app,” he told TechCrunch. “We're building the right immigration banking platform.”

It's an ambitious move. Transfer space in the Corridors of the UK, Nigeria, is one of the busiest fintech industries in Africa. From Lemfi, Send and Nala to Zepz and Taptap Send, immigrants don't have a shortage of options. With a sophisticated user experience, low prices and years of brand equity, these incumbents define the space.

For most new immigrants, choosing a transfer app is one of the earliest financial decisions they make. Often, it is through word of mouth. This means that Monieldo is not only behind, but he must fight against hardworking existing people who are already ingrained in everyday habits.

And while Moniepoint's entries bring size and reliability, some observers have questioned whether the market needs another remittance platform.

Google and DPI Back African Fintech Mony Points $110 Million Round

Eniolorunda hopes to help new immigrants return home and maintain their family and duties while settling abroad. Though there is little differentiation in the products and pricing for the former (transfers), a quick look at Monieworld's site shows you where it comes to offering better pricing than other platforms.

But it is not a moat in itself, but often a race to the bottom. Even Eniolorunda said, “We're not saying we're here for the cheapest,” the CEO said. “But we already have existing technology, processing rails and we have achieved economies of scale in many places, which means we can afford cheaper for our customers.”

Moniepoint has spent years building Nigerian infrastructure, from payments and cards to businesses and, more recently, retail consumer credit and compliance. The argument is that this same stack, reused for immigration, can provide more value than a standalone money transfer app.

The story continues