Lockheed Martin (NYSE: LMT) recently signed a memorandum with Electra.aero to explore EL9 aircraft, highlighting potential advances in military aviation. Over the last quarter, Lockheed Martin shares experienced a 7% increase. This is consistent with broader market trends. The move could be supported by announcements such as strategic partnerships such as Google Cloud integration, as well as breakthroughs in the C-130J Wing Structure Test as a result of robust revenue. The geopolitical stability in which oil prices slip and markets are considered to remain stable may have provided a fostering background for Lockheed Martin's share performance.

Every company has its own risk and you've found one weakness in Lockheed Martin that you should know about.

Diversify your portfolio with solid dividend payers that provide reliable revenue streams to potentially weather market turbulence.

The recent memorandum of understanding between Lockheed Martin and Electra to explore EL9 aircraft highlights Lockheed's commitment to strengthening military aviation technology. This development, in line with Lockheed Martin's strategic pivot, will integrate advanced AI, 5G and cloud technologies to increase future revenues through increased contracts and operational efficiency. Furthermore, existing partnerships from Lockheed, such as those using Google Cloud, may see reinforced relevance, further supporting the narrative of modernisation of technology that drives future growth.

Over the past five years, Lockheed Martin's total shareholder return ratio, including stock prices and dividends, was 50.43%. In comparison, Lockheed Martin has fallen below the performance of the US market, which has seen a return of 10.4% and the US Aerospace & Defense industry, which has returned by 33.2%. These figures highlight robust long-term performance, but show the need for more immediate industry trends and competitive responsiveness.

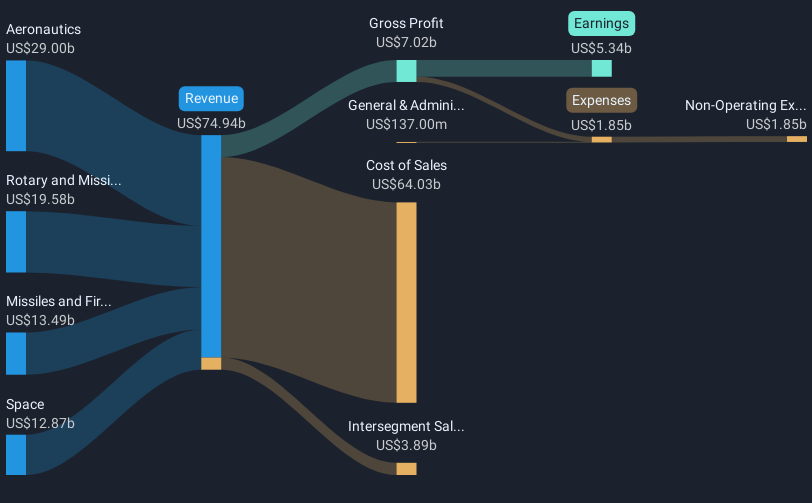

Given the analyst forecast, Lockheed's new technology integration could increase revenues at a 3.8% annual rate, with revenues likely to increase to US$7.2 billion by 2028. This suggests that the combined effects of technological advancements and strategic partnerships could have a significant impact on Lockheed's financial trajectory and market valuation over the next few years.

Reviewing the growth report provides insight into Lockheed Martin's future direction.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

New: AI Stock Screener & Alert

Our new AI Stock Screener scans the market every day to reveal opportunities.

•Dividend Powerhouse (yield of 3% or more)

Underrated small cap with insider purchases

High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email editorial-team@simplywallst.com