Africa Drone Market Size

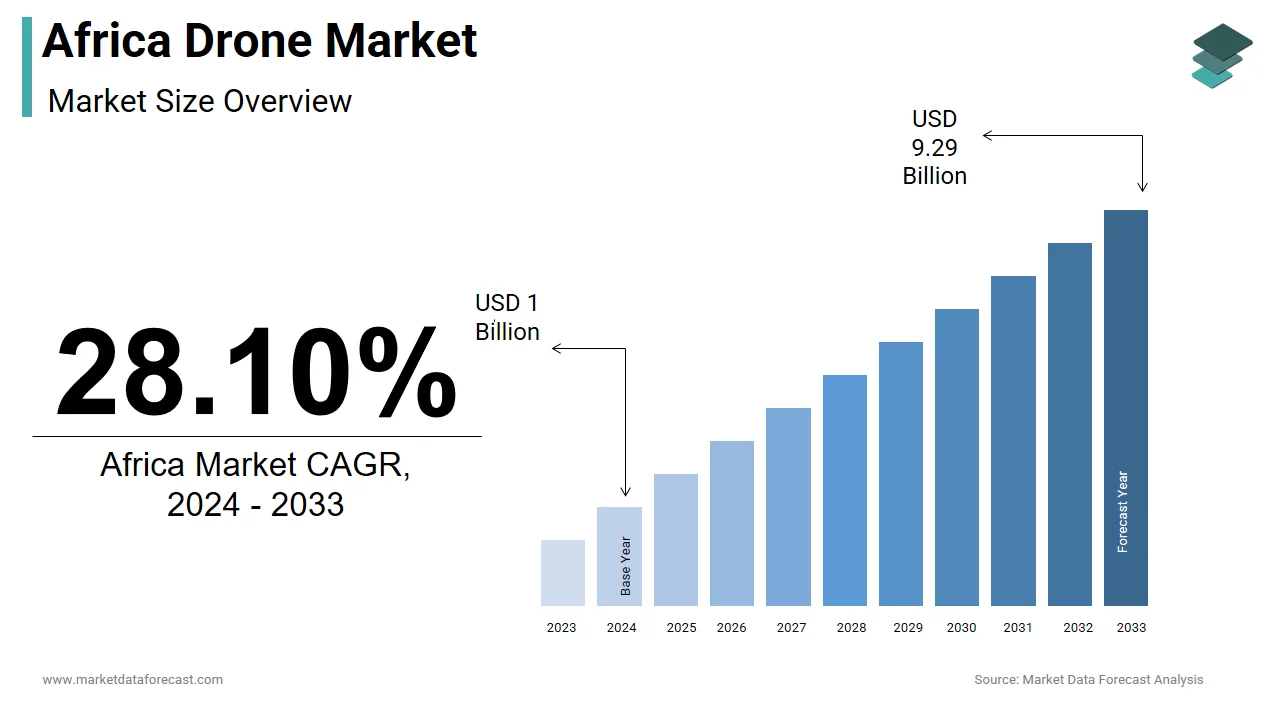

The size of the Africa drone market was valued at USD 1 billion in 2024 and is projected to reach USD 9.29 billion by 2033, growing at a CAGR of 28.10% from 2024 to 2033.

Drones are unmanned aerial vehicles (UAVs) deployed across commercial, industrial, agricultural, and governmental sectors. This market encompasses a wide range of applications, including precision agriculture, infrastructure monitoring, disaster response, logistics, and security operations. As African nations increasingly adopt technology-driven solutions for economic development and governance, drones are emerging as critical tools in enhancing efficiency and data collection capabilities.

According to the International Civil Aviation Organization noted that several African governments have partnered with global tech firms and NGOs to pilot drone-based delivery services, particularly for medical supplies in remote areas.

Apart from these, the expansion of digital infrastructure and mobile connectivity has enabled real-time drone operations and data transmission across vast geographies. As per the African Development Bank, investments in drone-enabled agriculture and logistics have surged, supported by regional innovation hubs and venture capital interest. These developments indicate that the Africa drone market is transitioning from experimental adoption to strategic deployment across multiple industries.

MARKET DRIVERS

Expansion of Agricultural Technology and Precision Farming

The increasing adoption of agricultural technology, particularly precision farming techniques aimed at improving crop yields and resource efficiency, is a key driver of the Africa drone market. With agriculture accounting for a significant portion of GDP and employment across many African economies, there is a growing recognition of the need for modern tools to optimize productivity.

According to the Food and Agriculture Organization, in 2023, over 60% of sub-Saharan Africa’s labor force was engaged in agriculture, yet average yields remained significantly lower than in other regions due to inefficient practices and limited access to advanced technologies. Drones equipped with multispectral sensors and imaging software are now being used to monitor soil health, detect pests, and manage irrigation more effectively.

Several startups and international organizations have launched drone-based farming initiatives across countries like Ghana, Kenya, and Nigeria. For example, WeFly Agritech in Kenya has been deploying drones for crop spraying and mapping, reducing chemical usage while improving yield estimation accuracy.

Increasing Demand for Medical Delivery and Emergency Response

The rising demand for medical delivery and emergency response services, especially in remote and underserved regions, is another major driver of the Africa drone market. Given the continent’s vast geography, inadequate road infrastructure, and frequent health emergencies, drones offer a reliable and rapid alternative for transporting life-saving supplies such as vaccines, blood products, and medicines.

As per Gavi, the Vaccine Alliance, in 2023, over 12 million people in sub-Saharan Africa lived in areas with poor access to healthcare facilities, making traditional transport methods ineffective during outbreaks or disasters. In response, several African countries have implemented drone-based delivery networks in collaboration with global partners.

For instance, Zipline, a U.S.-based drone logistics company, expanded its operations to Ghana and Nigeria in 2022, conducting over 100,000 deliveries of blood units and vaccines within two years.

The World Health Organization has endorsed drone delivery as a viable solution for strengthening health supply chains.

MARKET RESTRAINTS

Lack of Standardized Regulations and Airspace Management

The lack of standardized regulations and effective airspace management across most countries is one of the primary restraints facing the Africa drone market. While some nations have made progress in developing legal frameworks for drone operations, many others still operate under outdated aviation laws that do not account for the unique characteristics of UAVs.

According to the International Civil Aviation Organization, in 2023, only 18 out of 54 African countries had fully operational drone regulations, leaving large portions of the market in legal limbo. This inconsistency hampers investment, discourages foreign operators, and limits cross-border drone service deployment.

In addition, the absence of centralized air traffic control systems for drones creates safety concerns, particularly in urban environments where multiple users may be operating simultaneously without coordination. The African Union Commission has acknowledged these challenges and called for regional harmonization of drone policies to enable seamless integration into national airspace.

Limited Access to Skilled Operators and Technical Infrastructure

The limited availability of trained drone pilots, maintenance technicians, and technical infrastructure required for widespread deployment is another critical constraint in the Africa drone market. While interest in drone technology is growing, there remains a significant skills gap that prevents businesses and government agencies from leveraging UAVs effectively.

According to the African Institute for Mathematical Sciences, in 2023, fewer than 5,000 certified drone pilots existed across the entire continent, despite increasing demand for aerial surveying, monitoring, and delivery services. Many aspiring operators lack access to formal training programs or certification bodies recognized by national aviation authorities.

Moreover, the absence of dedicated drone repair centers, charging stations, and data processing facilities further complicates long-term operational sustainability. As per the United Nations Economic Commission for Africa, local enterprises often struggle to maintain equipment due to reliance on imported spare parts and proprietary software.

MARKET OPPORTUNITIES

Growth of Drone-Based Logistics and E-Commerce Integration

The expansion of drone-based logistics and its integration into e-commerce platforms, driven by the need for faster, more efficient delivery solutions in both urban and rural settings, is a major opportunity emerging in the Africa drone market. With the rise of online shopping and the limitations of existing transportation networks, drones present a viable alternative for last-mile delivery of goods ranging from pharmaceuticals to consumer electronics.

According to the International Trade Centre, in 2023, e-commerce sales in Africa were projected to surpass USD 40 billion by 2025, with countries like Nigeria, Egypt, and South Africa leading the charge. However, logistical inefficiencies, including poor road conditions and congested city centers, pose significant barriers to timely delivery.

To address this challenge, several startups and multinational companies are piloting drone delivery models tailored to African markets. For example, Nigerian logistics firm OneAir launched a drone parcel service in Lagos in 2023, aiming to reduce urban delivery times by up to 70%. Similarly, Jumia, the continent’s largest e-commerce platform, has expressed interest in integrating drone-assisted distribution into its supply chain.

Expansion of Geospatial Data Services and Urban Planning Applications

The increasing use of drones for geospatial data collection and urban planning, particularly in rapidly expanding cities facing infrastructure deficits, is another significant opportunity in the Africa drone market. Governments and private developers are turning to UAVs equipped with high-resolution cameras and LiDAR technology to create accurate land maps, assess infrastructure conditions, and plan sustainable urban development projects.

Also, the rapid urbanization has created urgent demands for updated cadastral records, drainage systems, and housing plans areas where drone-generated data can provide cost-effective and time-efficient insights.

In Kenya, the Ministry of Lands and Physical Planning launched a drone-based cadastral mapping initiative in 2023 to digitize property records and reduce land disputes. Similarly, in Ghana, the National Development Planning Commission has partnered with local drone firms to monitor informal settlements and guide infrastructure upgrades.

MARKET CHALLENGES

High Initial Investment Costs and Equipment Import Barriers

The high initial investment costs associated with acquiring and maintaining advanced drone systems, particularly for small and medium-sized enterprises, is one of the most pressing challenges confronting the Africa drone market. Despite declining prices globally, entry-level commercial drones equipped with essential sensors and GPS capabilities remain expensive for many African entrepreneurs and public sector agencies.

Besides, import duties and customs restrictions on drone components in several countries further inflate acquisition costs.

As per the Nigerian Civil Aviation Authority, these financial barriers have slowed the adoption of drone technology outside of government-backed or donor-funded projects.

Public Perception and Ethical Concerns Surrounding Drone Use

The skepticism and ethical concerns surrounding drone usage, particularly regarding privacy, surveillance, and misuse, is a persistent challenge in the Africa drone market. While drones offer numerous benefits, public perception in many regions remains influenced by misconceptions about their purpose and potential for abuse.

These fears are exacerbated by past incidents where drones were reportedly used for unauthorized monitoring, fueling distrust among communities.

Moreover, cultural resistance in rural areas has hindered the acceptance of drone-based interventions, particularly in agriculture and health delivery. In some regions, local populations have raised concerns about noise pollution, perceived foreign interference, or religious interpretations of aerial devices.

Addressing these concerns requires stronger community engagement, transparency in drone operations, and clear communication about the intended use of UAVs.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Application, Type, and Region.

Various Analyses Covered

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

Sudan, Egypt, Kenya, Ethiopia, Ghana, South Africa, Rest of Africa

Market Leaders Profiled

SZ DJI Technology Co., Ltd., Parrot SA FalconViz AeroVironment Inc., Israel Aerospace Industries Ltd., and others.

SEGMENTAL ANALYSIS

By Application Insights

The agriculture segment commanded the application category in the Africa drone market by accounting for 28.6% of total revenue in 2024. The sector’s reliance on technology to improve productivity and resource efficiency amid growing food security concerns is largely driving the dominance of agriculture segment.

According to the Food and Agriculture Organization (FAO), nearly 65% of Africa’s labor force is engaged in agriculture, yet yields remain significantly lower than global averages due to inefficient farming practices and limited access to precision tools. Drones equipped with multispectral sensors and imaging software are increasingly being used to monitor soil health, optimize irrigation, and apply fertilizers and pesticides more precisely.

In countries like Kenya, Nigeria, and Ghana, startups such as WeFly Agritech and Aerobotics have been deploying drones for crop monitoring and spraying, reducing input costs while improving yield estimation accuracy. As per the Alliance for a Green Revolution in Africa (AGRA), these innovations are expected to enhance smallholder farmer productivity and support sustainable agricultural transformation across the continent.

Moreover, governments and development agencies are funding pilot projects that integrate drone technology into national agricultural strategies, further reinforcing the sector’s leadership position in the Africa drone market.

The parcel delivery segment is the fastest-growing application segment in the Africa drone market, projected to expand at a CAGR of 27.4%. The rising demand for efficient logistics solutions in both urban and rural areas, where traditional delivery systems face infrastructure limitations, is attributed to the rapid ascent of the parcel delivery segment.

Urbanization and e-commerce expansion are also key drivers fueling this growth. According to the International Trade Centre, e-commerce sales in Africa were expected to surpass USD 40 billion by 2025, with major cities like Lagos, Cairo, and Cape Town witnessing a surge in online retail activity. However, traffic congestion and inadequate road networks pose significant challenges to timely deliveries.

To address this, companies like Zipline and OneAir have launched drone-based parcel services in Nigeria and Ghana, delivering medicines, documents, and consumer goods within minutes instead of hours. In Rwanda, drone deliveries have already become mainstream, with over 100,000 successful medical supply flights conducted since 2016, as reported by Gavi, the Vaccine Alliance.

By Type Insights

The rotary wing drones segment dominated the Africa drone market by capturing an estimated 64.4% share in 2024. These multirotor drones are favored for their vertical takeoff and landing capabilities, high maneuverability, and ability to hover in place features particularly valuable in applications such as surveillance, inspection, and aerial photography.

The versatility of rotary-wing drones makes them ideal for law enforcement, infrastructure inspection, and emergency response operations. For instance, in South Africa and Kenya, police and wildlife conservation units extensively use these drones for real-time monitoring and anti-poaching efforts. The World Wildlife Fund reported in 2023 that drone-assisted patrols in East African reserves had led to a reduction in illegal hunting incidents.

Moreover, their ease of operation and relatively lower cost compared to fixed-wing models make them accessible to startups, universities, and local government agencies, further strengthening their dominant position in the regional drone market.

The fixed-wing drones segment is the fastest-growing in the Africa drone market and is expanding at a CAGR of approximately 19.8% from 2025 to 2033. This growth is primarily fueled by their superior endurance, longer flight times, and ability to cover large geographic areas, making them ideal for mapping, surveying, and long-distance cargo transport is primarily fuelling the rise of fixed fixed-wing drones segment.

As per the United Nations Human Settlements Programme (UN-Habitat), in 2023, fixed-wing drones were increasingly deployed for geospatial data collection in rapidly expanding African cities, supporting land-use planning and infrastructure development initiatives.

In agriculture, fixed-wing drones are being used for large-scale crop monitoring, offering broader coverage than rotary models. In Ghana and Nigeria, agritech firms have adopted these drones to assess farmland conditions across vast hectares efficiently. The Food and Agriculture Organization noted that fixed wing UAVs improved field scanning speed by up to 60%, enhancing decision-making for farmers and agribusinesses.

Further, in Rwanda and Malawi, fixed-wing drones are being tested for long-range medical deliveries to remote communities, where road access is limited.

COUNTRY-LEVEL ANALYSIS

South Africa Drone Market Insights

South Africa held the leading position in the Africa drone market by commanding 21.4% of total revenue in 2024. It serves as a technological and regulatory benchmark for the region, hosting numerous drone manufacturers, research institutions, and regulatory innovation initiatives.

The country benefits from a well-developed aviation regulatory framework overseen by the South African Civil Aviation Authority (SACAA), which has introduced clear guidelines for commercial drone operations.

South Africa also hosts several drone-focused incubators and testing zones, including the Skukuza Drone Park in Kruger National Park, which supports conservation and surveillance applications. The Council for Scientific and Industrial Research (CSIR) has been instrumental in advancing drone-based geospatial analytics and defense technologies.

Nigeria Drone Market Insights

Nigeria is a key player in the Africa drone market, which is driven by increasing private-sector investment and government-led initiatives aimed at leveraging drones for logistics, agriculture, and public safety.

According to the Nigerian Civil Aviation Authority, drone registrations increased by over 40% between 2021 and 2023, reflecting heightened interest from entrepreneurs and enterprises. The Federal Ministry of Agriculture has partnered with agritech startups to deploy drones for crop monitoring and pesticide application, particularly in states like Kano and Ogun.

Apart from these, Lagos has emerged as a hub for drone-based delivery services, with companies like OneAir launching test flights for urgent medical and commercial package transportation. As per the Nigerian Economic Summit Group, drone-enabled logistics could reduce last-mile delivery costs in urban centers.

Despite regulatory hurdles and import tariffs, Nigeria’s dynamic startup culture and digital innovation landscape position it as a key growth driver in the regional drone market.

Kenya Drone Market Insights

Kenya maintains a notable share of the Africa drone market, recognized for its progressive regulatory environment and early adoption of drone technology in humanitarian and developmental contexts. The country was among the first in Africa to establish a comprehensive drone policy framework through the Kenya Civil Aviation Authority (KCAA).

According to the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), Kenya has hosted several international drone trials focused on disaster response, vaccine delivery, and refugee camp monitoring. Zipline’s medical drone operations, launched in western Kenya in 2021, have expanded blood product availability to over 1,000 health facilities.

Moreover, Nairobi has become a regional center for drone innovation, with institutions like the University of Nairobi and Jomo Kenyatta University of Agriculture and Technology conducting advanced research on autonomous flight and AI integration.

Kenya’s commitment to fostering drone entrepreneurship and regulatory clarity ensures its continued influence in shaping the future of the Africa drone market.

Egypt Drone Market Insights

Egypt is positioning itself as a key player in defense and infrastructure-related drone deployment. The Egyptian military has been one of the most active users of UAVs in Africa, integrating both domestically produced and imported drones into surveillance and reconnaissance operations.

According to the Egyptian Ministry of Defense, in 2023, the armed forces operated over 200 tactical and strategic drones, including locally assembled versions of Chinese and Emirati models. The government has also invested in indigenous drone manufacturing capabilities, with state-owned factories producing surveillance and combat UAVs.

Beyond defense, Egypt has explored drone applications in agriculture and urban planning. The Ministry of Water Resources has employed drones to monitor irrigation systems along the Nile Delta, while urban planners in Cairo have used aerial surveys to manage informal settlements and traffic congestion.

Morocco Drone Market Insights

Morocco is emerging as a policy leader in North Africa with proactive regulatory reforms and investments in drone technology for border security and civil applications.

The government has also supported local drone startups through incubation programs and partnerships with European aerospace firms. Companies like Dronetech Morocco have been involved in aerial mapping for renewable energy projects and coastal monitoring.

Furthermore, Morocco’s strategic location and participation in trade agreements with the EU and African Union position it as a potential export hub for drone components and services. These developments reinforce Morocco’s role as a key contributor to the evolution of the Africa drone market.

KEY MARKET PLAYERS

Some of the noteworthy companies in the Africa drone market profiled in this report are SZ DJI Technology Co., Ltd., Parrot SA, FalconViz, AeroVironment Inc., Israel Aerospace Industries Ltd., and others.

TOP LEADING PLAYERS IN THE MARKET

Zipline

Zipline is a leading player in the Africa drone market, renowned for its innovative approach to medical supply delivery using drones. Operating in Ghana and Nigeria, the company has demonstrated how UAVs can transform healthcare logistics by enabling rapid, reliable transport of blood products and vaccines to remote facilities. Its scalable model and strong partnerships with governments have positioned it as a global benchmark in drone-based health logistics.

Aerobotics

Aerobotics specializes in agricultural drone technology and data analytics, offering precision farming solutions tailored for African conditions. The South African-based firm uses AI-powered drone imagery to help farmers detect crop diseases, optimize irrigation, and improve yields. By integrating drone data into farm management systems, Aerobotics supports sustainable agriculture practices and contributes to global advancements in agritech.

WeFly Agritech

WeFly Agritech is a homegrown Nigerian drone services provider focused on transforming smallholder farming through affordable drone-based spraying, mapping, and monitoring solutions. It plays a crucial role in making drone technology accessible to local farmers, enhancing productivity and reducing input waste. Its work reflects Africa’s growing capacity to develop indigenous drone applications that address regional agricultural challenges while contributing to the continent’s tech innovation landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Africa drone market is localizing operations and forming strategic government partnerships. Companies are increasingly collaborating with national regulators and public institutions to ensure compliance, gain operational legitimacy, and access large-scale deployment opportunities in sectors like healthcare and agriculture.

Another widely adopted approach is leveraging mobile and digital infrastructure to enhance drone operations. Firms are integrating real-time GPS tracking, cloud-based data analysis, and mobile payment systems to streamline service delivery, especially in remote areas where traditional logistics networks are limited.

A third critical strategy involves investing in workforce development and local training programs. Recognizing the shortage of skilled drone operators, leading companies are partnering with universities and vocational institutions across Africa to train local talent, ensuring long-term sustainability and community engagement in drone-based initiatives.

COMPETITION OVERVIEW

The competition in the Africa drone market is intensifying as both international and regional players seek to capture emerging opportunities across diverse sectors such as agriculture, healthcare, security, and logistics. Multinational firms bring advanced technologies and global expertise, while local startups offer cost-effective, context-specific solutions tailored to African environments. This dynamic creates a competitive yet collaborative ecosystem where innovation thrives.

Regulatory developments are shaping the competitive landscape, with countries like Kenya, South Africa, and Ghana introducing progressive frameworks that encourage investment and experimentation. However, barriers such as high equipment costs, limited technical skills, and inconsistent airspace policies continue to challenge widespread adoption.

Public-private partnerships are becoming a defining feature of the market, allowing private firms to scale their impact through government-backed programs. At the same time, venture capital interest in African drone startups is rising, further fueling entrepreneurship and technological adaptation. As demand for efficient, scalable aerial solutions grows, the Africa drone market is evolving into a vibrant hub of innovation and strategic collaboration.

RECENT MARKET DEVELOPMENTS

In January 2023, Zipline expanded its medical drone delivery network to additional hospitals in northern Ghana, enhancing coverage and response times for critical blood supplies in underserved regions. In May 2023, Aerobotics launched an AI-driven drone analytics platform tailored specifically for smallholder farmers in East Africa, improving accessibility and affordability of precision agriculture tools. In October 2023, WeFly Agritech partnered with the Nigerian Ministry of Agriculture to deploy drone spraying services across five states, aiming to boost crop yields and reduce pesticide misuse among rural farmers. In February 2024, South African drone manufacturer DTN Aviation secured a partnership with a European aerospace firm to co-develop long-range surveillance drones for use in conservation and border security applications. In June 2024, OneAir initiated commercial drone deliveries in Lagos, marking a milestone in urban logistics and demonstrating the feasibility of drone-assisted e-commerce fulfillment in densely populated African cities.

MARKET SEGMENTATION

This Africa drone market research report is segmented and sub-segmented into the following categories.

By Application

Construction Agriculture Energy Entertainment Law Enforcement Parcel Delivery Other Applications

By Type

Fixed Wing Drones Rotary Wing Drones

By Country

Sudan Egypt Kenya Ethiopia Ghana South Africa Rest of Africa