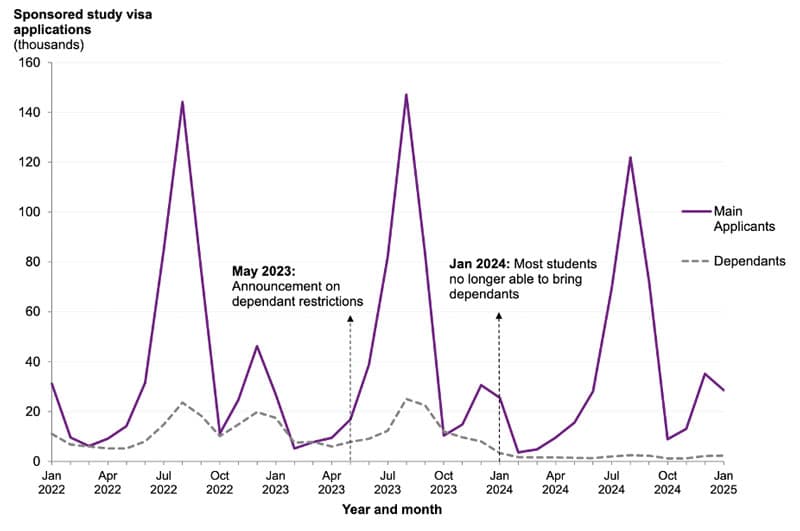

Last week we reported data showing that international students' visa applications and UK study grants increased from the end of 2024 to the first quarter of this year. The recent increase is in contrast to New Year's Day data from the UK Department of Interior detailing the decline in sponsored visas issued in 2023 and 2023. The data confirms that the so-called dependent ban, which came into effect in January 2024, had a major impact on UK student demand in top markets such as Nigeria, India and Banradesh.

Since January 2024, most international students have not been permitted to bring their families with them while studying in the UK. The only exceptions are students in research-oriented graduate programs and students in government-sponsored scholarships.

Before the ban, students in the teacher program were allowed to bring their families. This was the main reason why these programs were so popular in emerging markets. Its popularity has declined since the start of the ban on dependents. As reported in higher education in the era, the share of masters' research visas fell from 66% in 2023 to 61% in 2024. Currently, the countries currently consider the largest visas in India, China and Pakistan.

As shown in the chart below, there was an 84% reduction in dependent applications for the year ended January 2025.

Sponsored research visas down 14%

In 2024, a total of 393,125 sponsored research visas were issued to key applicants (i.e. students) with a 14% decline compared to 2023.

“The biggest losses (if some data trends are retained) come from non-EU countries, including Nigeria and India. (Except) the impact on Chinese students is minimized by trends in “added proportions.” Nigerian students were 1.16 for Nigerian students compared to below 0.01 for Chinese students. ”

Sure enough, visas issued to students in Nigeria and India fell by -55% and -26% in 2023, respectively, compared to 2024. In contrast, Chinese student publications fell by just -6%.

A much milder softening of the Chinese market has restored China's status as the best international student source for British educators, overturning the two-year trend in 2022 and 2023, when India held its place. India is currently second, with 88,860 visas issued compared to China's 102,940 in 2024.

Visas for Indian students have been dropped at both the master's and undergraduate levels. Nicholas Dillon, director of Nous Group, commented on LinkedIn about trends in Indian faculties. It is clear that Indian students are considering a wider range of options for studying abroad, much more widely than they did in the past.

Nepal's switch spot between Nigeria and Pakistan, and demand remains strong

The dramatic -55% drop-off from Nigeria (a somewhat surprising 13% increase from Pakistan) means that Pakistan is now the UK's third student market, with Nigeria hitting fourth.

The overall surge in Pakistan highlights the extremely strong demand for UK education from Pakistan, even if visas issued to Pakistani dependents fall by 85%. Pakistan's dependency and application ratio was actually slightly higher than India before 2024 (0.37 vs. 0.31, respectively). Therefore, the ban on dependents does not seem to have a significant impact on academic decision-making in Pakistan than in India. Visa issuance to Pakistani students has increased at both undergraduate and graduate levels.

Like Pakistan, demand from Nepal remains strong, with 44% more visas issued in 2024 than in 2023, growing at both undergraduate and graduate levels. Nepal is currently the UK's third largest undergraduate market and represents the sixth largest overall undergraduate market.

Other non-EU markets are weakening for a variety of reasons

Several other important student markets in the UK have weakened. Within the top 10, the biggest drop in survey visa issuance was in Malaysia (-12%), Hong Kong (-15%), Saudi Arabia (-16%), and in particular Bangladesh (-31%).

The dropout from Bangladesh could be linked to dependent ban given the very high dependency and application ratio over the past few years (1.01%).

The decline from Malaysia and Hong Kong may have something to do with the rise of alternative destinations in Asia, such as Malaysia and Hong Kong's ambition to become a hub for regional education. University UK has pointed out that demand in Malaysia has declined in recent years, both in research in the UK and in Malaysia via UK cross-border education agreements. At the same time, Malaysia has the goal of attracting 250,000 foreign students by 2025.

Hong Kong is also looking to recruit more international students. In 2019/20, Hong Kong University had 12,350 undergraduate international students, up 14,760 from 20% in 2024. Most of these students are from China, but India is becoming more prioritized. Eight public universities in Hong Kong joined together last year to recruit Indian students, particularly those who are strong in STEM.

Meanwhile, in the Middle East, both the UAE and Saudi Arabia are increasing the number of foreign partnerships and branch campuses to attract more foreign students.

According to the issuance of research visas, the UK's top 10 markets, 2024

China: 102,940

India: 88,860

Pakistan: 35,045

Nigeria: 18,900

US: 15,275

Nepal: 12,235

Bangladesh: 6,400

Malaysia: 5,420

Hong Kong: 5,180

Saudi Arabia: 4,875

For additional background, see: