Homeowners in areas most exposed to climate disasters are increasingly forgoing insurance premiums, exposing them to financial ruin, according to extensive new government data.

How climate change is making home insurance more expensive and harder to keep, even as wildfires, hurricanes and other disasters increasingly threaten many people's most valuable assets. The numbers show how much it is eroding the foundations of American life.

Source: National Association of Insurance Commissioners and Federal Insurance Bureau, U.S. Department of the Treasury.

“Homeowners insurance is where many Americans are feeling the economic impacts of climate change directly in their pocketbooks,” said Ethan Zindler, the Treasury Department's climate change counselor. “Nature doesn't really care whether people live in a blue state or a red state or another state, or whether they believe in climate change or not.”

The rise in cancellation rates is part of a broader trend captured by the Treasury Department, which analyzed information on 246 million policies issued by 330 U.S. insurance companies from 2018 to 2022. The result is the most comprehensive study to date of the global impact of climate change. American home insurance market.

Homeowners with a mortgage are usually required by their lender to purchase insurance. However, if you own your home outright, perhaps because the property has been in your family for decades or even generations, you have the option of discontinuing your insurance.

The numbers show that the cost and frequency of insurance claims are rising rapidly in the highest-risk areas of the United States, as defined by the Federal Emergency Management Agency. These indicate that the financial stress on insurance companies is also increasing.

Insurance premiums are similarly rising, rising much more in high-risk areas than in other areas.

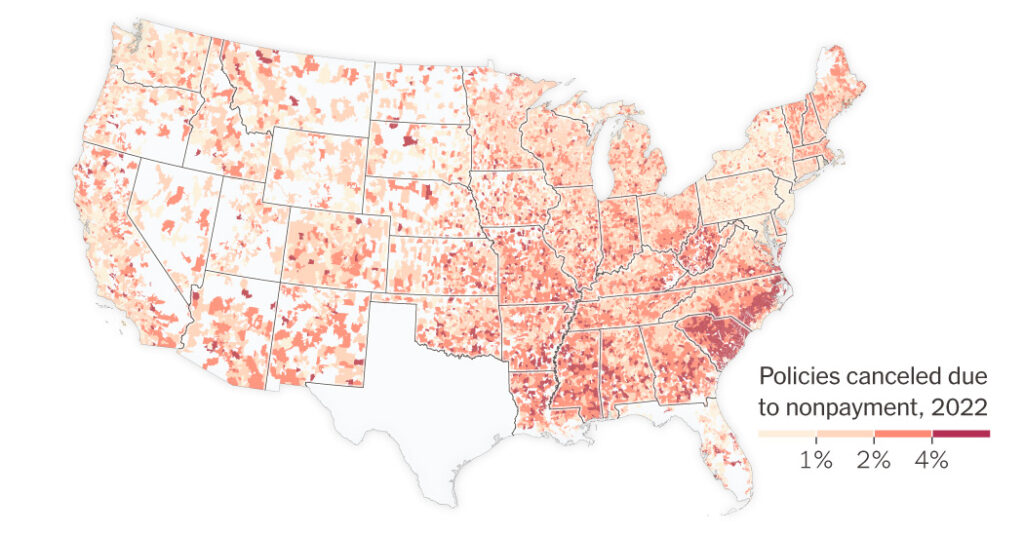

As these trends worsen, more people are losing their insurance plans. It happens in two ways. One is when an insurance company cancels a homeowner who doesn't pay premiums. The other is due to non-renewals, where insurance companies refuse to renew policies for homeowners who want to continue paying premiums.

Both cancellation and non-renewal rates are increasing, with the increases being most pronounced in high-risk regions.

Source: National Association of Insurance Commissioners and Federal Insurance Bureau, U.S. Department of the Treasury. FEMA.

Data shows that in more than 150 ZIP codes across the country, insurers canceled at least 10% of home insurance policies in 2022 (the latest year for which figures are available) because homeowners did not pay their premiums. The highest cancellation rates were in coastal areas of the Carolinas that are particularly vulnerable to hurricanes, such as Hilton Head, Charleston and Myrtle Beach. It was also high in parts of West Virginia, Arizona and California.

The data does not capture why homeowners choose to stop making payments. But Nellie Liang, the Treasury Department's undersecretary for domestic finance, said her team sees this as an indicator that families are facing increased financial stress exacerbated by climate change. .

“Households cannot bear the burden on their own,” Liang said.

Non-renewal rates were also higher and increased faster in high-risk areas, where insurers refused to renew policies even for paying customers. The ZIP codes with the highest rates of nonrenewal in 2022 were in coastal South Carolina and parts of California, including wildfire-hit Sonoma and Yuba counties. Areas in Tennessee that experienced severe storms also had high non-renewal rates.

Liang said it's not just homeowners who will be hurt by the instability in the home insurance market. It also threatens the property tax revenue that communities depend on, as tax revenue could decline if homeowners are unable to rebuild or their homes decline in value. It also hurts local businesses that rely on homeowners as customers.

“There's a lot to worry about,” Liang said.

The Treasury Department's data collection efforts have been complicated by political conflicts over climate change and the question of who should regulate insurance companies.

The department announced the initiative in 2021 as part of the Biden administration's efforts to address the economic impacts of climate change. The original plan was to collect data directly from insurance companies. But some state insurance commissioners (who regulate the industry) opposed it, supported by Republicans in Congress.

So the Treasury Department had state commissioners collect the data. Or not: Seven states declined to participate: Florida, Alabama, Louisiana, Georgia, Indiana, Montana, and North Dakota. According to the Treasury Department, this means local insurance companies that happen to be headquartered in those states did not provide the data. However, national insurance companies were still providing data on homeowners with insurance coverage in those states. (Another exception is Texas, which did not provide some data.)

Additionally, participating states chose to withhold some key information, such as state-mandated high-risk insurance plan data. These plans are aimed at providing insurance to people who cannot get insurance through regular insurance companies, and are becoming increasingly important as climate change worsens. Excluding those plans means the data does not capture the experiences of many homeowners who face the greatest risks from climate threats.

The National Association of Insurance Commissioners, which compiled the data on behalf of state commissioners, shared only a portion of the data collected with the Treasury Department.

The association did not respond to requests for comment.

As part of the report, the Treasury Department urges state commissioners and national associations to work with the department's Federal Insurance Administration to collect and publish data annually, and expand that effort to include information on high-risk populations. I asked.

The likelihood of that happening is unknown. Last month, Republican state insurance commissioners sent a letter to Elon Musk and Vivek Ramaswamy, the leaders of what President-elect Donald J. Trump is calling the new Department of Government Efficiency, urging them to completely abolish the federal Insurance Agency. I asked for it.

They say the agency's climate change data collection efforts show the federal government is overstepping its authority, and that by moving forward with releasing new data, the agency risks “misleading the public.” “We chose to proceed with flawed information.” ” Commissioners did not say why they considered this information flawed.

methodology

Seven state insurance departments did not participate in the Treasury Department's data collection: Alabama, Florida, Georgia, Indiana, Louisiana, Montana, and North Dakota. In some cases, national insurance companies that offer coverage in these markets have submitted data for those states. Texas insurance company data provided by the National Association of Insurance Commissioners did not include nonpayment cancellations or nonrenewals.

Risk categories are based on composite risk scores from FEMA's National Risk Index. Policy surrender and non-renewal rates represent the average within each risk category.