In July alone, the International Monetary Fund (IMF) reportedly is considering loan expenditures to Egypt and Ethiopia, sparking new concerns over an increased reliance on IMF support.

Though often said to be essential for a struggling economy, the long-term impact of rising IMF debt is becoming an increasing problem across the continent.

Egypt received $1.2 billion, increasing its total spending to $3.5 billion after completing its fourth review of its $8 billion loan program. However, the IMF warned that Egypt is facing “high sovereign stress,” with its foreign debt forecast to exceed $220 billion by 2030, from $162.7 billion in 2024/25.

Meanwhile, Ethiopia has secured $262 million following its third review of its program, but its financial situation remains sensitive.

The country is currently in discussions with official creditors to restructure its $8.4 billion in debt under the G20 Common Framework, and is preparing to repay 1 billion euros.

The double weight of IMF loans and commercial debt continues to grow national budgets and delay growth-centric projects.

On July 8, the IMF released a new analysis note entitled “How to Stabilize Debt in Africa.” This emphasized that debt stabilization depends heavily on “stronger institutions, growth-friendly fiscal reforms, and IMF-supported macro stability.”

Senegal offers an example of caution. After allowing staff to underreport their debt, expenditures were stopped and the debt-to-GDP ratio was revised from 74% to over 100%. As a result, S&P has downgraded the country and IMF support is pending until a reliable recovery plan is implemented.

These examples highlight a broader issue. IMF loans can avoid economic collapse, but often have strict conditions, austerity demands and limited space for domestic priorities.

Without effective debt management, the country risks falling into a cycle of repeated borrowing and repayment, damaging both economic security and public trust.

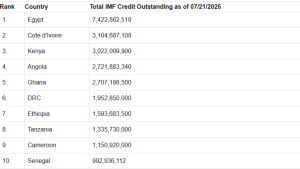

As of July 2025, the IMF database lists the African countries with the highest debt burden on institutions. Compared to last month, credit levels have risen in Egypt, Ivory Coast, Ghana, the Democratic Republic of the Congo, Ethiopia and Tanzania, while other countries have seen cuts.

The top 10 countries in Africa with the highest IMF debt in July 2025.

Credit: Business Insider